Market Research Solutions Experts

Our Solutions

SMARI combines creative methodologies with a strategic mindset to uncover consumer insights. Whether building a brand, enhancing customer experience, or developing a product, we put the consumer at the center of every decision.

Research Solutions Curated for Your Market

Research is most valuable during times of change, and SMARI provides the insights to guide your next steps.

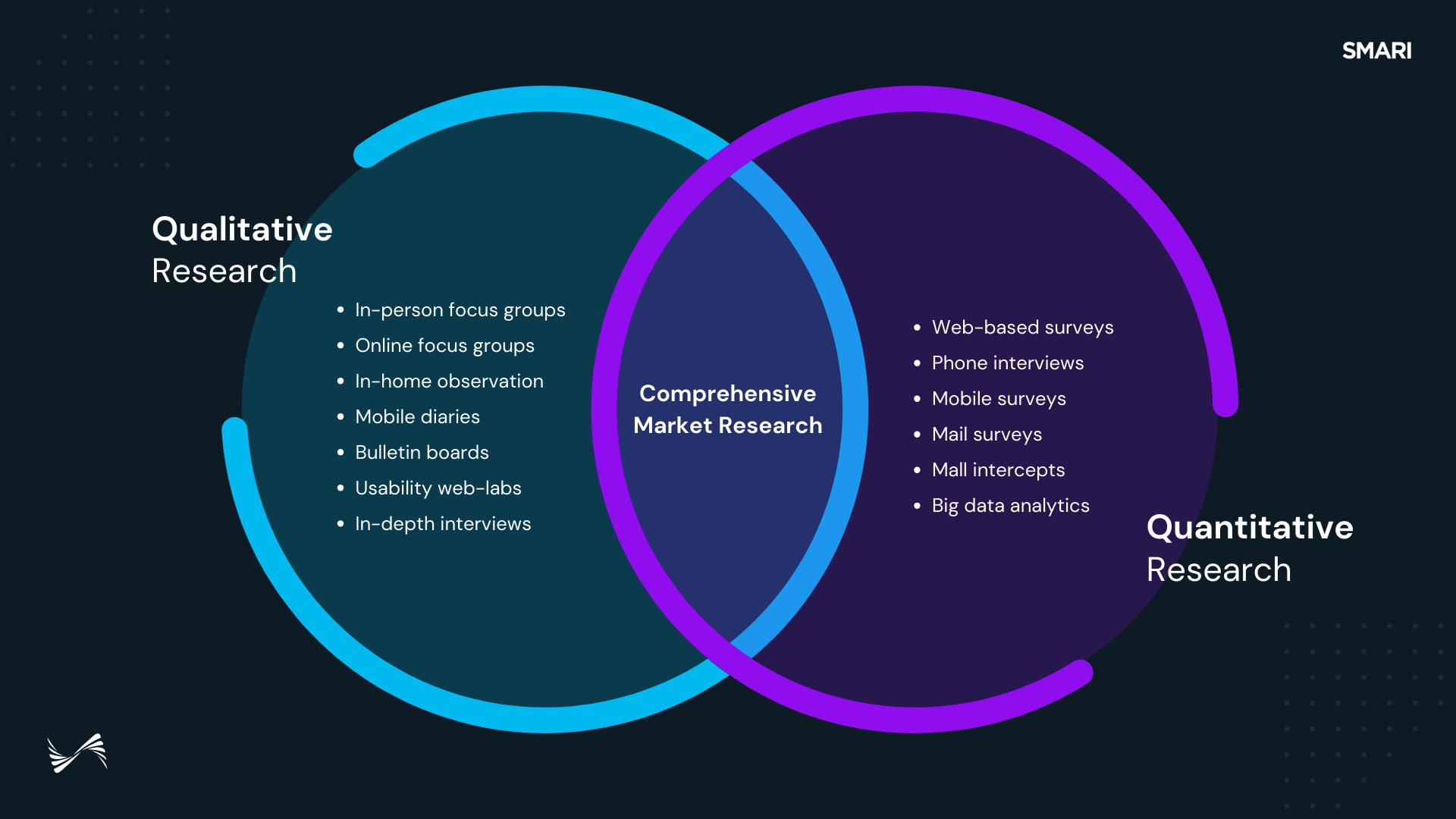

Whether through qualitative focus groups or quantitative surveys with advanced modeling, we tailor our approach to your needs. Our process starts with understanding your objectives and ends with clear, actionable strategies that drive real impact.

Digging Deeper, Thinking Smarter

For 40 years, SMARI has specialized in solving complex research questions with a blend of art and science.

We go beyond surface-level answers, driven by a genuine curiosity to uncover the insights that matter. Our team takes every project personally, pushing deeper to find the “ah-ha” moments that lead to real, strategic solutions.

Relevant results through a blended, customized approach.

Our Market Research Solutions

Brand Research

Define your brand’s personality, understand its reputation, and uncover key differentiators to gain a competitive edge. If you don’t shape your brand’s narrative, the market will. Research reveals where your brand stands today and where it should go in an evolving landscape. These insights unite teams, guide marketing strategies, and help reinvent established brands. Key methodologies include:

Brand Awareness

Brand Health

New Markets

Market Position

Brand Personality

Project Tracking

Leadership Continuity

Brand Continuity

Focus Enhancement

Message Impact

Identify barriers

Loyalty Assessment

Usage & Attitudes (U&A)

Understanding how consumers think and act can ensure that the voice of the consumer is at the center of product development, market expansion, and developing focused marketing strategies. Comparing the behaviors and attitudes of existing customers to prospective consumers can provide benchmark comparative to define a target market. Key aspects and methodologies include:

Market Share

Usage Patterns

Sentiment Analysis

Brand Mapping

Profile Users

Gap Analysis

Advertising Recall

“Moment of Truth”

Quadrant Analysis

Trend Analysis

Purchase Funnel

SWOT Analysis

Innovation & Optimization

Research won’t hand you the next big idea, but it will reveal what consumers need, the challenges they face, and what resonates emotionally. These insights lay the foundation for innovation, giving teams the tools to develop products, services, and campaigns that truly connect. Key methodologies include:

Observational Research

Usability Testing

Jobs To Be Done

Ideation Focus Group

Concept Testing

Leadership Interviews

Emotional Impact

Pain Point Identification

Feature Prioritization

Customer Experience & Journey Mapping

Understanding the consumer means examining their journey from start to finish. At SMARI, we focus on two key stages: the path to purchase and the brand experience. Knowing what attracts consumers and how they engage with your brand reveals insights for acquisition and retention. Key methodologies include:

Key Driver Analysis

Net Promoter Score

Customer Effort Score

Quadrant analysis

Gap Analysis

Sentiment Analysis

Touchpoint Analysis

Experience Tracking

Customer Lifetime Value

Co-Creation

Segmentation & Targeting

Segmentation has the power to bring teams together by speaking the same language – the consumer language. Having a deep understanding of the type of consumer that provides the greatest opportunity and alignment with the brand, can provide direction to every department of an organization. Key aspects and methodologies include:

Persona Development

Predictive Modeling

Market Sizing

Customer Benchmarking

Niche Market Discovery

Segmentation Maps

Pricing Strategies

Journey Mapping

Positioning & Messaging Testing

Designing new product packaging, describing a new service, choosing a new brand campaign, these are all costly endeavors. Taking a step back and checking in with the consumer to ensure that marketing communication pieces are effectively reaching the consumer with the right message and driving a call to action can save the organization costly, ineffective marketing. Key aspects and methodologies include:

Package Optimization

Discrete Choice Prioritization

Logo Interpretation

Sentiment Analysis

Highlighter Diagnostic

Heat Mapping Diagnostic

Market Reach Optimization

Brand Alignment

Polarization Identification

Qualitative Research

While we value quantitative insights, some answers go beyond data—context matters. Research is strongest when layered with discovery, and listening to consumers is at the core of market research. Qualitative research is an art, and SMARI’s trained, certified moderators approach it with precision. Key methodologies include:

Focus Groups

In-depth Interviews

Stakeholder Interviews

Sentiment Analysis

Mobile App Usability Testing

Website Intercepts

Shop-Alongs

Observation Research

Ideation Sessions

Co-Creation Research

Mystery Shops

Mobile Diaries

Our Process

SMARI is a full-service research provider, handling everything from methodology to analysis so you don’t have to. From the first conversation, we focus on understanding your needs—asking the right questions to uncover what matters most.

With this foundation, we design a custom research plan tailored to your unique challenges. Our team isn’t just skilled in data; we’re curious problem-solvers who connect the dots in ways others don’t. Clients return to SMARI for our strategic mindset and the meaningful insights we deliver.

Project Kickoff

Moderated kickoff meeting with stakeholders to solidify objectives and develop hypotheses to prove or disprove in research.

deliverables

- Ideation

- Connect Research with Outcome

Instrument Development

Custom development of a survey, moderator’s outline, or other research guideline with consideration of proper question sequence and innovative techniques to ensure high quality data output.

deliverables

Survey Programming

Programming to include advanced features and to provide a positive respondent experience to include mobile optimization.

deliverables

- Advanced Features

- Respondent Engagement

- Mobile Optimized

Data Collection

Recruitment of respondents, monitoring of consumer representation, and validity of respondent participation.

deliverables

- Consumer Targeting

- Data Integrity

- Quota Control

Analysis & Reporting

Visual summarization to ensure easy interpretation including a consultative interpretation and recommendations.

deliverables

Presentation of Results

Review of results with stakeholders for complete understanding with strategic insights and recommendations. After the presentation, the SMARI team remains available indefinitely to provide support.

deliverables

- Clarity

- Next Steps

- Support

How long is a typical research engagement?

Projects typically last between 4 to 8 weeks depending on the methodology used. Some projects can be expedited for results within a week.

How much does a project cost?

The answer we all hate: It depends. The biggest factors in determining cost is the type of audience being targeted (the more niche, the more difficult to recruit for research), type of methodology used, and complexity of analysis. Most engagements start at $15,000. Each engagement is a project. The project will be designed and priced at the start so you know what you are getting, how long it will take, and how much it costs before starting.

What industries do you work in?

All of them. Over the course of 40 years, we have collected experience and partnerships is most industries. This diversity in research experience has engendered more creative solutions with out of the box ideas.

Can you provide examples of your work and case studies?

Yes and no. We can provide generic examples, but our clients come to us for unique solutions and proprietary research. Showing and telling what was truly insightful on a research project would be giving away proprietary answers. Trust us, you will appreciate this when you have your answers in hand. You will not want to share either.

Do you only serve clients in Indiana?

No. Approximately half of our clients are located in Indiana. The other half spreads across the U.S. and even take international roots.

How do you recruit research participants?

Through diverse methods and a stringent quality control process. SMARI houses an internal panel used only for SMARI projects. Given the target audience, SMARI also partners with over 30 reputable providers to diversify recruiting tactics and approaches. Through this tenured and crafted network, SMARI has the ability to target niche audiences and B2B decision makers. This includes participants that are not professional survey takers and are specifically recruited to participate.

We understand that our insights are only as good as the data that is collected. Since we pride ourselves on thoughtful insights, we need reliable, accurate data. For this reason, SMARI uses an 18-step process to ensure respondent integrity. Yes, 18 steps.

Who is actually managing our research project?

There is no sales team at SMARI. From the initial conversation, a SMARI Account Consultant will discuss the research needs, design the project, oversee the process, craft the analysis, and deliver a consultative presentation. There is no sales hand-off here. This might not be the most efficient process, but it is the one that ensures that the initial request matches the end results. We pride ourselves in results and partnerships, not profit margins.

What is the deliverable?

The final deliverable is a summary report, a consultative delivery, and a continuous partnership after delivery. This report includes the basic charted data, but also advanced analytics, summary analysis, key findings and answers to research objectives, and recommendations. The consultative presentation goes beyond the summary report to provide context, comparatives, industry insights and experience. With over 100 projects conducted each year for over 40 years, experience helps to guide the interpretation of results for greater understanding.

Some projects may also include online dashboards, infographics, ideation sessions, etc. SMARI will work with the team to understand what works best to leverage insights.

What involvement does the client have during the project?

Our clients are involved in several key areas:

- Project kickoff to define the objectives and brainstorm working hypotheses

- Survey review and approval

- Observation of research if qualitative is recommended

- Presentation of results

Clients will receive status reports each Monday that define what was accomplished the prior week and what will be accomplished in the upcoming week.

Sometimes the size of the project or the number of stakeholders required a refined process which SMARI is happy to accommodate. This can look like weekly status meetings, preliminary review of results before a final presentation, etc.